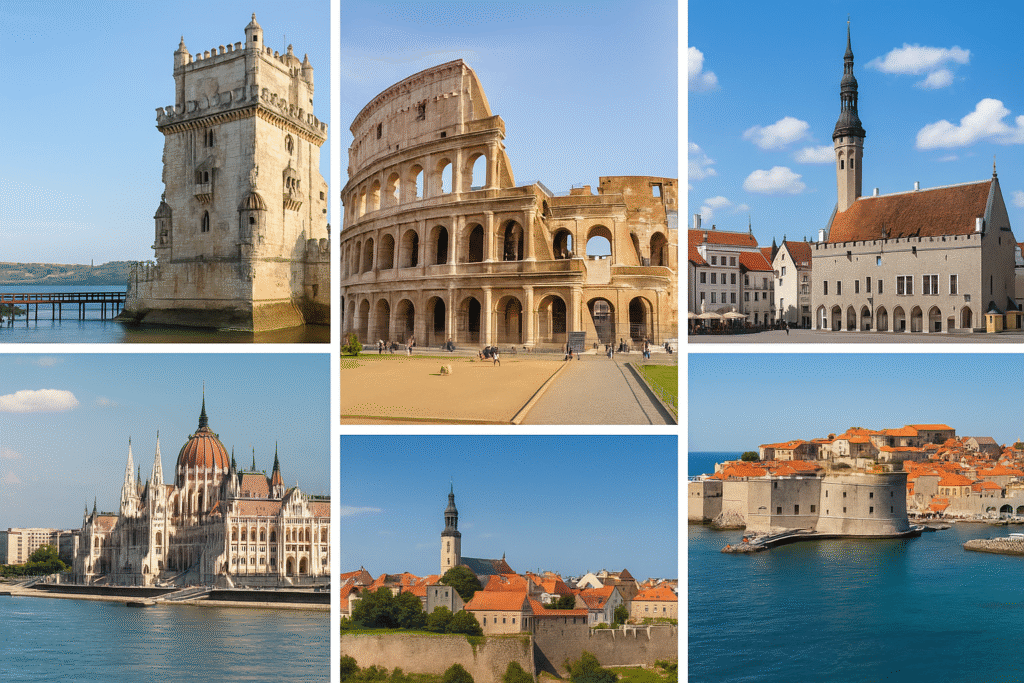

“Live legally in Europe. Work from anywhere. Discover the power of digital freedom.”

In the age of remote work, 2025 is a landmark year for global mobility. The European Union is now home to 11 countries offering exclusive digital nomad visas, allowing you to live legally in Europe while working remotely for international companies or clients.

But which country is best for you? What income do you need? Which visas allow family members? What are the tax implications?

This is the most comprehensive and up-to-date guide available, built to empower your decision.

What is a Digital Nomad Visa?

A digital nomad visa is a legal residence permit that allows:

-

Remote professionals to live in a European country,

-

Without needing to work for a local employer,

-

While maintaining freelance contracts or remote jobs abroad.

EU Countries Offering Digital Nomad Visas in 2025

Currently, 11 EU member states offer official visas tailored to remote workers. Each one comes with its own rules regarding duration, income requirements, renewability, and taxation:

| Country | Visa Name | Initial Duration | Renewable? |

|---|---|---|---|

| 🇵🇹 Portugal | D8 Temporary Residence Visa | 1 year | Yes |

| 🇪🇪 Estonia | Digital Nomad Visa | 1 year | No |

| 🇪🇸 Spain | Digital Nomad Visa (Startup Act) | 1 year | Yes, up to 5 years |

| 🇮🇹 Italy | Digital Nomad Visa | 1 year | Yes, for highly skilled pros |

| 🇲🇹 Malta | Nomad Residence Permit | 1 year | Yes |

| 🇭🇷 Croatia | Digital Nomad Visa | 1 year | Yes, once |

| 🇨🇾 Cyprus | Digital Nomad Visa | 1 year | Yes, up to twice |

| 🇨🇿 Czechia | Zivno “Trade License” Visa | 6–12 months | Yes |

| 🇬🇷 Greece | Digital Nomad Visa | 1–2 years | Yes |

| 🇭🇺 Hungary | “White Card” | 1 year | Yes |

| 🇷🇴 Romania | Digital Nomad Visa | 1 year | Yes |

What Should You Consider Before Applying?

Minimum Monthly Income

-

From €2,000/month (Italy, Hungary) up to €3,700/month (Romania).

Visa Duration & Renewability

-

From 6 months (Czechia) to up to 5 years (Spain with renewals).

Including Spouse and Children?

-

Portugal, Cyprus, Malta: family-friendly.

-

Hungary: does not permit dependents.

Tax Benefits or Risks

-

Portugal (NHR 2.0) and Spain (15% flat rate) offer tax incentives.

-

Most countries will consider you a tax resident after 183 days, triggering local tax obligations.

Top Benefits of a Digital Nomad Visa in the EU

-

Legal residence and Schengen Area access.

-

Maintain contracts with international clients or employers.

-

Path to long-term residency or EU citizenship.

-

In some countries, favorable tax regimes for new residents.

Key Challenges & What to Watch Out For

-

High minimum income requirements.

-

Proof of existing professional activity or academic degree.

-

Some visas are not renewable (e.g., Estonia).

-

After 183 days, you may owe local income tax.

Which EU Country Is Right for You?

Ask yourself:

-

How long do I want to stay?

-

Am I traveling solo or with family?

-

Do I care more about cost of living or tax optimization?

-

Am I seeking a long-term path to residency or citizenship?

Your answer defines your strategy — whether it’s sunny Portugal, culturally rich Spain, or tax-friendly Malta.

How to Ensure Your Application Succeeds

Don’t risk it alone. Global Steps Advisory offers:

-

Personalized visa strategy,

-

Legal document preparation,

-

Application assistance,

-

Legal support from international mobility lawyers.

Secure your freedom with expert guidance. Your European life starts now.

Final Takeaway: This is More Than a Visa

The EU digital nomad visa is your ticket to a better lifestyle, increased freedom, and a global career.

If you dream of:

-

Working from a terrace in Lisbon,

-

Enjoying tapas in Seville between Zoom calls,

-

Or raising your kids on a Greek island while freelancing online…

2025 is your year. Europe is open. Are you ready to move?

Frequently Asked Questions (FAQs)

Can I work for a local company with this visa?

No. It’s meant for remote work for foreign clients or employers.

Can I bring my spouse and kids?

Yes, in most countries — but income requirements increase.

Do I have to pay taxes in the country I move to?

Yes, if you stay over 183 days, you’ll become a tax resident.

Which country has the easiest application process?

Malta and Croatia are known for being straightforward.

Is there a unified EU nomad visa?

No, each country has its own separate process.

Can I switch to a long-term residency later?

Yes, many countries allow this transition after 2–5 years.